Angkas

Angeline Tham and George Royeca Smart CityAngkas is the leading motorcycle ride-hailing app in the Philippines. Angkas provides an efficient and cost-effective transportation option, allowing more than 8 million customers to call one of its 50,000+ motorcycle riders with the click of a button.

edamama

Bela Gupta D'Souza and Nish D'Souza Retail & Consumer Techedamama is the PH’s leading online-to-offline (O2O) home and parenting platform. edamama’s personalized and content/community-driven shopping experience for affordable and authentic baby, child, parenting and household products, catalyzes convenience for families seeking these essential goods.

Lhoopa

Marc-Olivier Caillot and Sabrina Tan Retail & Consumer TechLhoopa leverages technology to make affordable housing streamlined, decentralized, and profitable in Southeast Asia. It employs data, algorithms, and proprietary tech to analyze data, invest in undervalued properties, and manage the entire construction, sales, and client lifecycle.

CloudEats

Kimberly Yao and Iacopo Rovere Food & BeverageCloudEats is a pioneer food service company in Southeast Asia creating next-generation digital brands and proprietary technology. It has served over 3 million customers in the Philippines and Vietnam.

Inteluck

Kevin Zhang Smart CityInteluck is a B2B first and middle-mile logistics company leveraging proprietary data and technology to optimize supply chain inefficiencies across SEA. Founded in 2014, the company operates across Southeast Asia with over 300+ large enterprise customers and has raised $20M+ in funding to date.

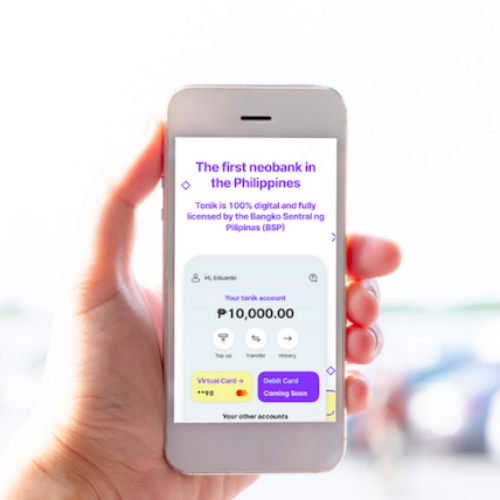

Tonik

Greg Krasnov FintechTonik aims to close the massive gap in consumer lending as the second Bangko Sentral ng Pilipinas (BSP) licensed neobank in the Philippines, offering a purely digital solution for scaling financial services.